We all live busy lives, and the last thing we want to do is spend hours trying to set up a payment system. That’s why Stripe is perfect for businesses and individuals who need a quick, easy, and secure way to take payments. With Stripe, you can start taking payments in minutes, without having to worry about complex setup or security issues.

Stripe is one of the most popular payment processors available today, and for good reason.

It is also one of the most flexible payment processors available. You can use Stripe to take payments via credit card, debit card, or even ACH bank transfer.

Stripe works with most major eCommerce platforms, making it easy to integrate into your existing website or online store.

Stripe has become one of the most popular payment processors because it makes it easy to set up shop and start processing payments quickly. But what about safety and security?

Rest assured, Stripe takes security and fraud prevention seriously. They use best-in-class technology to keep your data safe and have a team of experts who are constantly monitoring for fraud.

Plus, Stripe is easy to set up. You can be up and running in minutes, and there’s no need to worry about complex integration or installation.

Pros of Using Stripe

There are many reasons why you might want to consider using Stripe for your business. Here are some of the biggest advantages of using Stripe:

– Fast and easy to set up

– No complex setup or security issues

– Works with most major eCommerce platforms

– Flexible payment options

– Very secure

Cons of Using Stripe

– Fees can be high for some businesses

– Some features are only available on the paid plans

Based on my experience, the pros of using Stripe far outweigh the cons. If you are looking for a safe and fast way to take payments, then Stripe is a great option.

We’ve used many payment processors in the past, but we’ve never seen anything quite like Stripe. Setting up an account is a breeze, and their support has been fantastic.

How to Set Up a Stripe Account

Creating a Stripe account is easy and only takes a few minutes. You can sign up for a free Stripe account here. After you create your account, you’ll be asked to provide some basic information about your business, such as your business name and website.

Once you’ve provided this information, you’ll be able to access your Stripe Dashboard. This is where you’ll be able to view your account activity, manage your settings, and connect your bank account so you can start receiving payments.

Connecting Your Bank Account

Stripe makes it easy to connect your bank account so you can start receiving payments. To do this, simply click on the “Bank Accounts” tab in your Stripe Dashboard and follow the instructions. You’ll need to provide your bank account number and routing number, as well as some other basic information.

Once you’ve connected your bank account, you’re ready to start receiving payments. All you need to do is add your stripe secret key to your website or app, and you’re good to go!

Receiving Payments

Whenever a customer makes a purchase on your website or app, Stripe will process the payment and deposit the funds into your bank account. You can view all of your transactions in the “Transactions” tab of your Stripe Dashboard.

Setting Up Recurring Payments

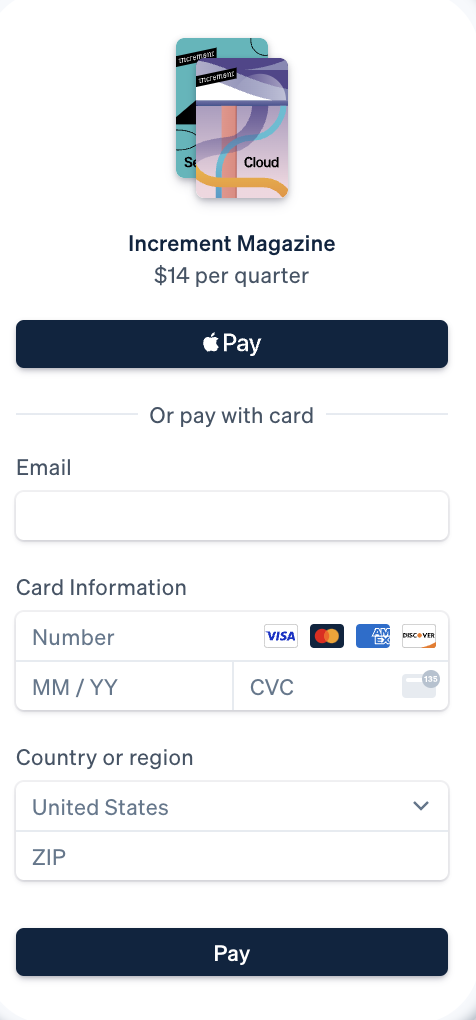

If you’re selling a subscription or other service that requires recurring payments, Stripe makes it easy to set this up. Simply click on the “Recurring Payments” tab in your Stripe Dashboard and follow the instructions. You’ll need to provide some basic information about your product or service, as well as your pricing.

Once you’ve set up your recurring payments, Stripe will automatically charge your customers on a regular basis and deposit the funds into your bank account. You can view all of your recurring payments in the “Recurring Payments” tab of your Stripe Dashboard.

Stripe Fees

Stripe charges a small fee for each transaction that you process. For most businesses, this fee is 2.9% + $0.30 per transaction. You can view a complete list of Stripe’s fees here.

What Type of Payments Do Stripe Accept?

Stripe accepts all major credit cards, including Visa, Mastercard, American Express, and Discover. Stripe also supports Apple Pay, Google Pay, and Microsoft Pay.

Is Stripe Safe?

Yes, Stripe is a safe and secure way to accept payments online. Stripe uses state-of-the-art security measures to protect your data, and their support team is always available to help if you have any questions or concerns.

Have you ever used Stripe? Let us know in the comments below!